texas auto sales tax

Completed Application for Texas Title andor Registration Form 130-U The following fees. Some dealerships may charge a documentary fee of 125 dollars In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees.

What S The Car Sales Tax In Each State Find The Best Car Price

After you enter those into the blanks you will get the Dallas City Tax which is 01.

. While the sales tax is decided based on the cost of the vehicle the registration fee will depend on the type and weight of the car. You can count on Texas Auto for an opulent service experience from the moment you enter our showroom. This calculator can help you estimate the taxes required when purchasing a new or used vehicle.

If you are buying a car for 2500000 multiply by 1 and then multiply by 0825. 14-112 Texas Motor Vehicle SalesUse Tax Payment PDF 14-115 Texas Motor Vehicle Sales and Use Tax Report PDF For County Tax Assessor-Collector Use Only 14-116 Texas Motor Vehicle Sales and Use Tax Report Supplement PDF For County Tax Assessor-Collector Use Only 14-128 Texas Used Motor Vehicle Certified Appraisal Form PDF Used by Private Party. The permit issue date is November 4 2020.

The principal address is 2217 Fm 1960 Rd Houston TX 77073-2407. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. A seller should keep detailed written records of any transaction including contact information for the buyer the date of sale and information on the vehicle including the vehicle identification number vin.

For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in Texas. 21650 for a 20000 purchase Houston TX. Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to factor in state taxes titling and registration fees vehicle inspectionsmog test costs and car insurance into your total cost.

Signed Application for Texas Title andor Registration Form 130-U with the sales price clearly shown. This means that depending on your location within Texas the total tax you pay can be significantly higher than the 625 state sales tax. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax.

Texas criminal failure to pay sales tax penalty is a Class C misdemeanor if tax collected and not paid is less than 10000. With local taxes the total sales tax rate is between 6250 and 8250. The administrative fee covers all documentary costs as well as overnight shipping for titles paperwork title transfers etc the dealer service fee consolidates other typical dealer.

Learn more about the Texas Auto buying process. When a repair person repairs or rebuilds component parts that a customer places in inventory or installs on a vehicle other than the vehicle from which the part was. The Texas Comptroller states that payment of motor vehicle sales.

Add this to the Dallas MTA tax at 01 and the state sales tax of 0625 combined together give you a tax rate of 0825. A motor vehicle sale includes installment and credit sales and exchanges for property services or money. The sales tax for cars in Texas is 625 of the final sales price.

Texas has 2176 special sales tax jurisdictions with local. The seller has the option to remove their license plates and. Texas TX Sales Tax Rates by City Texas TX Sales Tax Rates by City The state sales tax rate in Texas is 6250.

TEXAS AUTO SALES AND SERVICE Taxpayer 32072775581 is a taxpayer entity registered with Texas Comptroller of Public Accounts. A seller should keep detailed written records of any transaction including contact information for the buyer the date of sale and information on the vehicle including the Vehicle Identification Number VIN. Proof of sales tax payment or current foreignmilitary ownership document.

The thing about sales tax is that it is sales tax. Answer 1 of 5. Select the Texas city from the list of popular cities below to see its current sales tax rate.

If the 20th falls on a weekend or holiday the. A vehicle inventory tax of approximately 0027 only 27 per 10000 sale price and a 299 dealer service fee. 2nd degree felony if tax 100000 or more.

State jail felony if tax is 10000 less than 20000. Texas Auto Sales Tax. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825.

Monthly sales tax reports are due on the 20th of each month. Registration fee base fee of 5075 for passenger vehicles and light trucks Title application fee of 28 or 33 depending on the county State portion of the vehicle inspection fee up to 3075 Local. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

Utahs criminal failure to file sales tax penalty is a 3rd degree felony. 3rd degree felony if tax is 20000 less than 100000. If all you did was a loan modification that aint no big thing.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. For passenger vehicles you may pay up to 5075 as a registration fee or 30 for motorcycles and between 45 and. The Texas Comptroller of Public Accounts explains the sales tax treatment of repair services performed on motor vehicle component parts.

Fillable Form 14125 Texas Motor Vehicle SellerFinanced from. Texas Taxability for Motor Vehicle Repair Services. This blog gives instructions on how to file and pay sales tax in Texas using Form 01-114 Sales Use Tax Return a return commonly used by out-of-state sellers.

For retail sales of new and used motor vehicles involving motor vehicle dealers licensed in Texas see Use Tax Due on Texas-Purchased Motor Vehicles in this section or in another state Texas law bases the motor vehicle use tax on a motor vehicles sales price with no deduction allowed for depreciation or use prior to entering Texas. A transfer of a motor vehicle without payment of consideration that does not qualify as a gift is a retail sale and is subject to the 625 percent motor vehicle tax. Texas has recent rate changes Thu Jul 01 2021.

Texas offers a few different types of sales tax returns. You can find these fees further down on. You are going to pay 206250 in taxes on this vehicle.

Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas. Saved Vehicles Texas Auto. It is a tax on SALES.

You cannot get a title until you pay other taxes. Texas collects a 625 state sales tax rate on the purchase of all vehicles. Motor vehicle sales tax is due on each retail sale of a motor vehicle in texas.

Visit us today at our South location 16200 Hwy 3 Webster TX 77598 or our North locaton- 11655 North Fwy Houston TX 77060-our seasoned professionals are ready to answer any questions you may have. Texas residents have to pay vehicle sales tax and registration fees when buying a new car.

The States With The Lowest Car Tax The Motley Fool

Car Tax By State Usa Manual Car Sales Tax Calculator

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Registration Fees Penalties And Tax Rates Texas

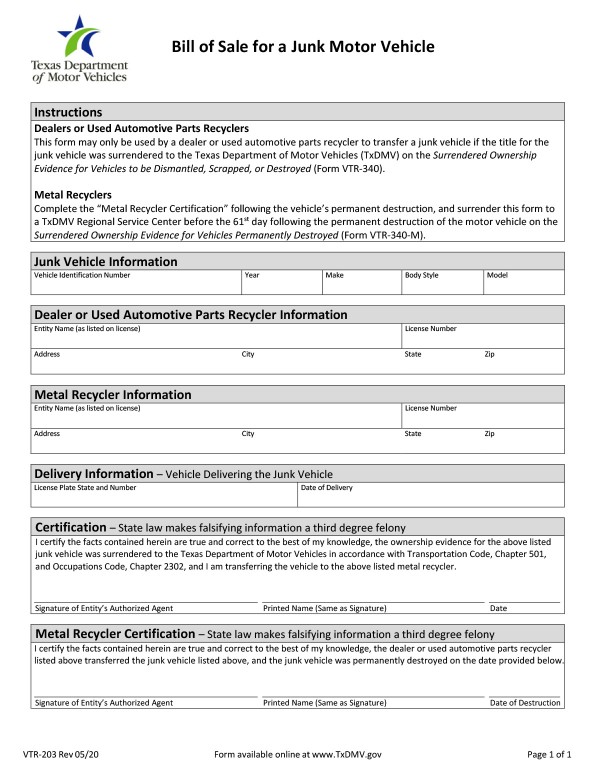

Texas Bill Of Sale Form Templates For Car Boat Fill Out And Download

Which U S States Charge Property Taxes For Cars Mansion Global

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

What S The Car Sales Tax In Each State Find The Best Car Price

Free Texas Dmv Bill Of Sale Form For Motor Vehicle Trailer Or Boat Pdf

How To Gift A Car In Texas 500 Below Cars

Texas Sales Tax Guide And Calculator 2022 Taxjar

Nj Car Sales Tax Everything You Need To Know

States With Highest And Lowest Sales Tax Rates

Texas Car Sales Tax Everything You Need To Know

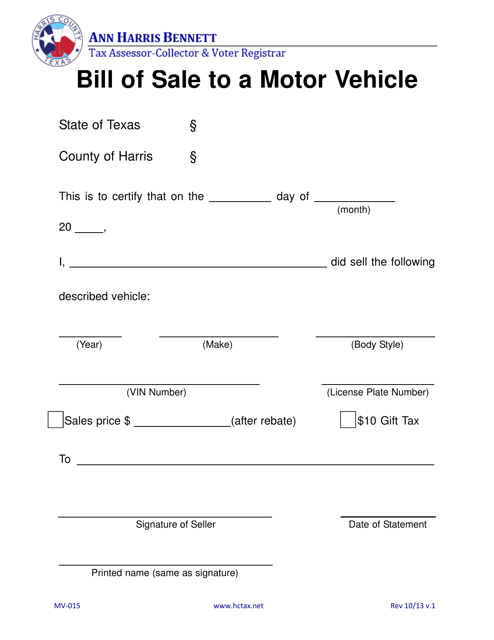

Form Mv 015 Download Fillable Pdf Or Fill Online Bill Of Sale To A Motor Vehicle Harris County Texas Templateroller

Create A Free Texas Bill Of Sale Form Pdf Doc Legaltemplates