canadian tax strategies for high income earners

The current top marginal tax rate in the US is 37. Fortunately thoughtful tax planning can help you your business andor your family keep more of what you have worked so hard to accumulate.

If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available.

. Tax Strategies For Families With Children. In 2021 the employee pre-tax contribution limit. The Canadian tax system specifies tax rates for the various income levels and.

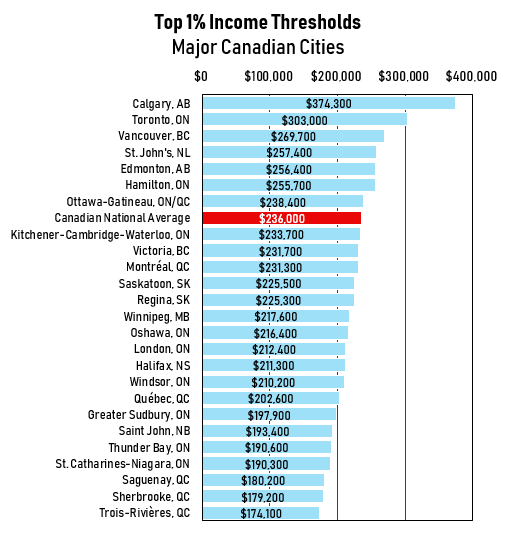

Knowing the right tax reduction strategies for high-income earners is key to lowering your income taxes. An overview of the tax rules for high-income earners. The top bracket is.

Qualified Charitable Distributions QCD 4. Tax Saving Strategies for High-Income Earners. Income splitting and trusts.

And things are about to get worse if President Biden gets his way. If properly structured family trusts or partnerships can help you move your. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000.

This article highlights a non-exhaustive list of tax. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Vehicle and travel expenses.

Tax Strategies for High Income Earners PillarWM. Tax Planning Strategies For High-Income Canadians Registered Education Savings Plan RESP. In this article we highlight 3 tax.

The SECURE Act. Max Out Your Retirement Account. As a refresher for 2021 FY the.

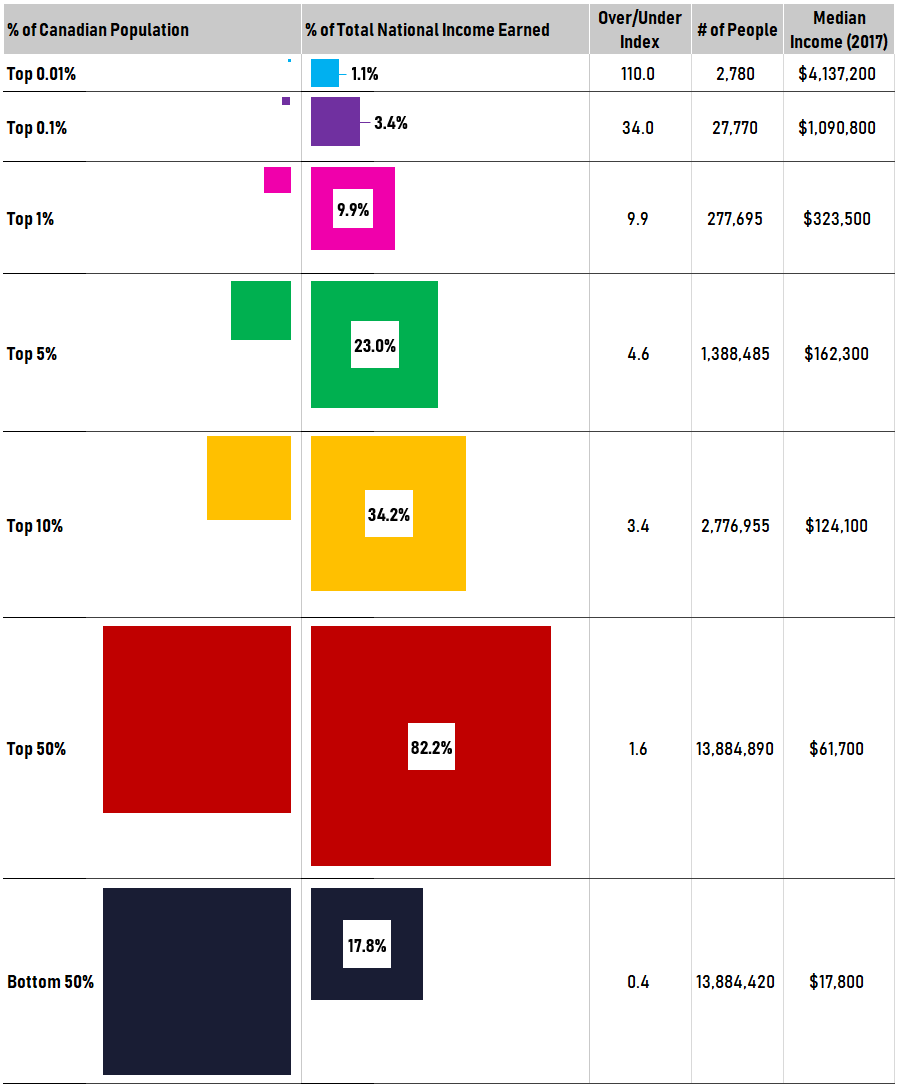

Contribute to your superannuation fund. The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions. The average Canadian has access to 2-3 tax-sheltered accounts and can shelter 30 of their gross income.

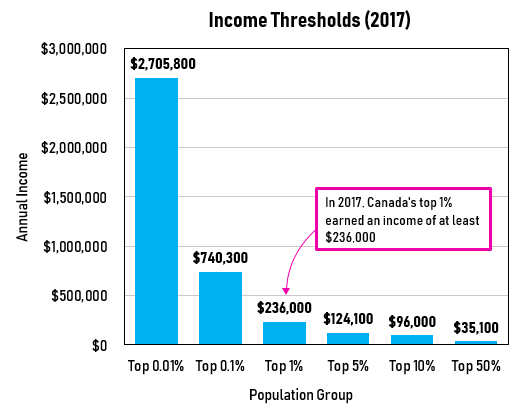

8 Ways The TFSA Could Change. This is one of the most important tax strategies for you as a high-income earner. When your income exceeds a certain limit you are subject to high taxes which can go up to rates of 50 of your total.

Tax planning for high income canadians. Tax Planning Strategies for High-income Earners. Thats especially true if you earn more than 400000 as.

In this example the minimum repayment amount will be 1667 each year for 15 years until the. How to Reduce Taxable Income. High-income earners make 170050 per year.

We will begin by looking at the tax laws applicable to high-income earners. This is also called salary packaging and it works a few. 6 Tax Strategies for High Net Worth Individuals.

One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account.

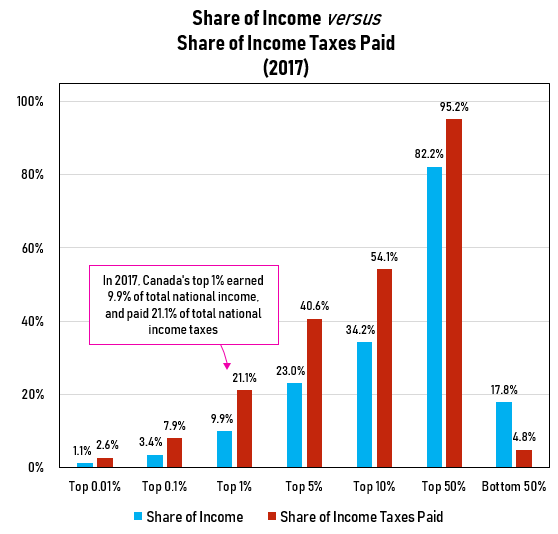

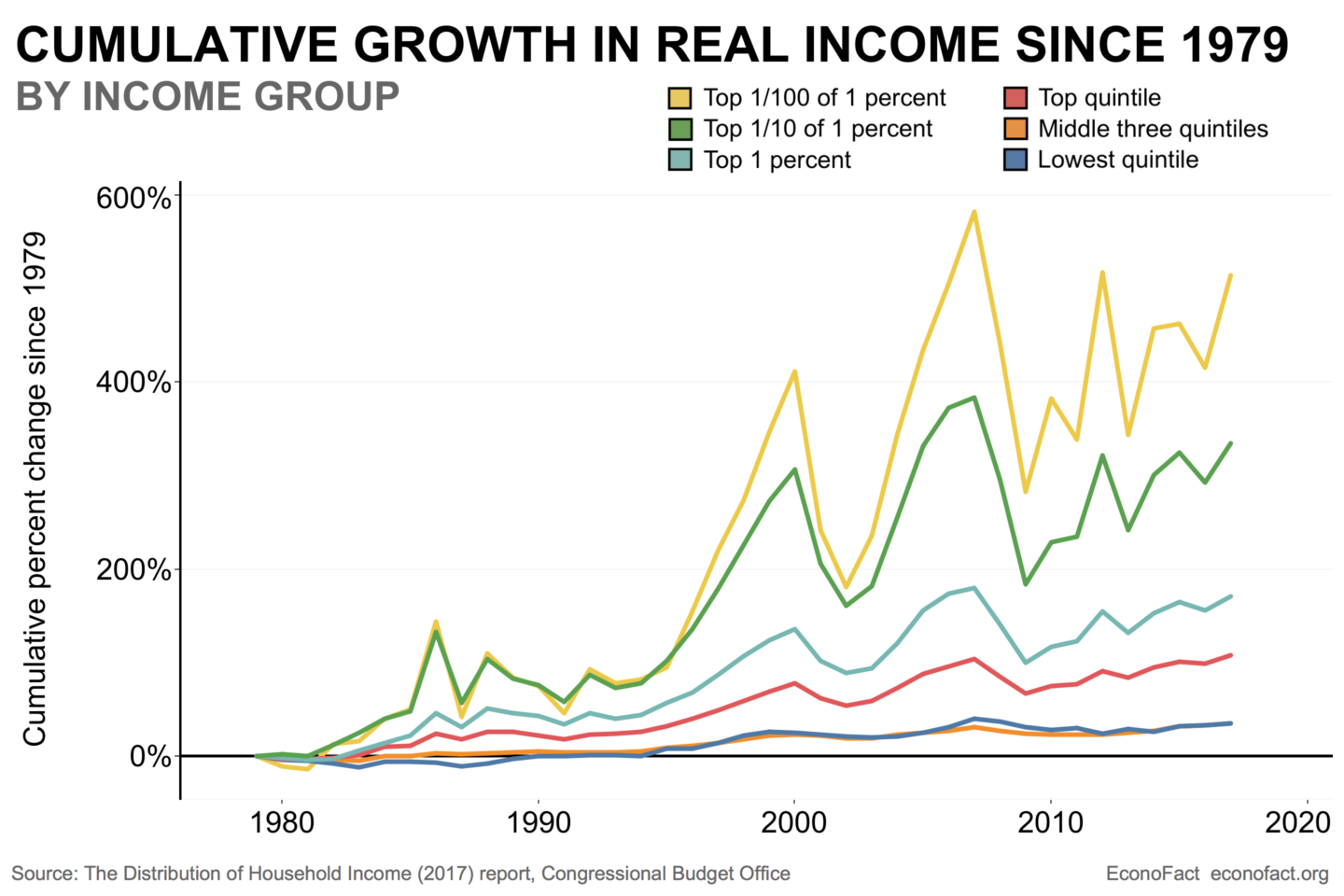

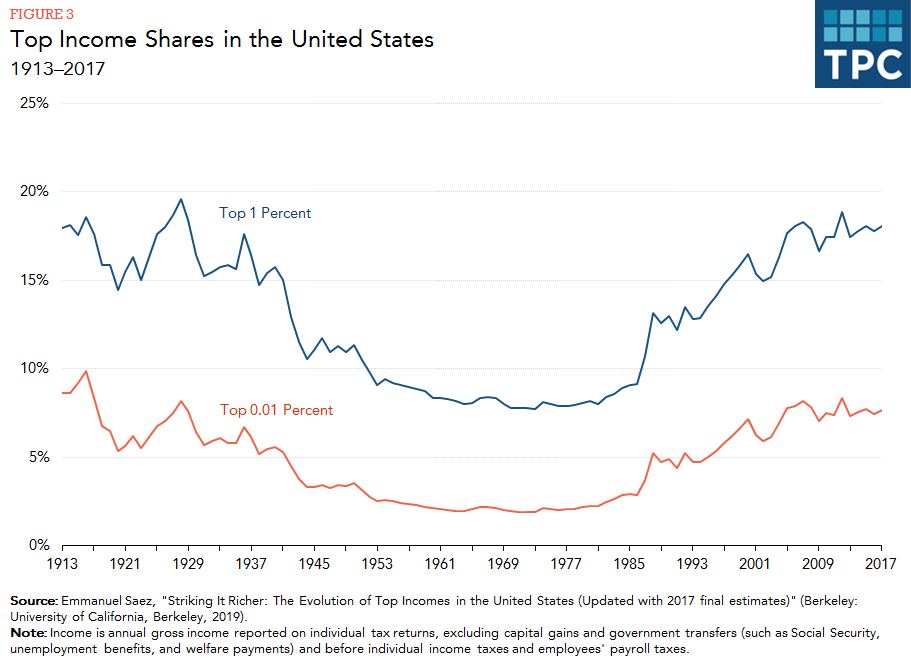

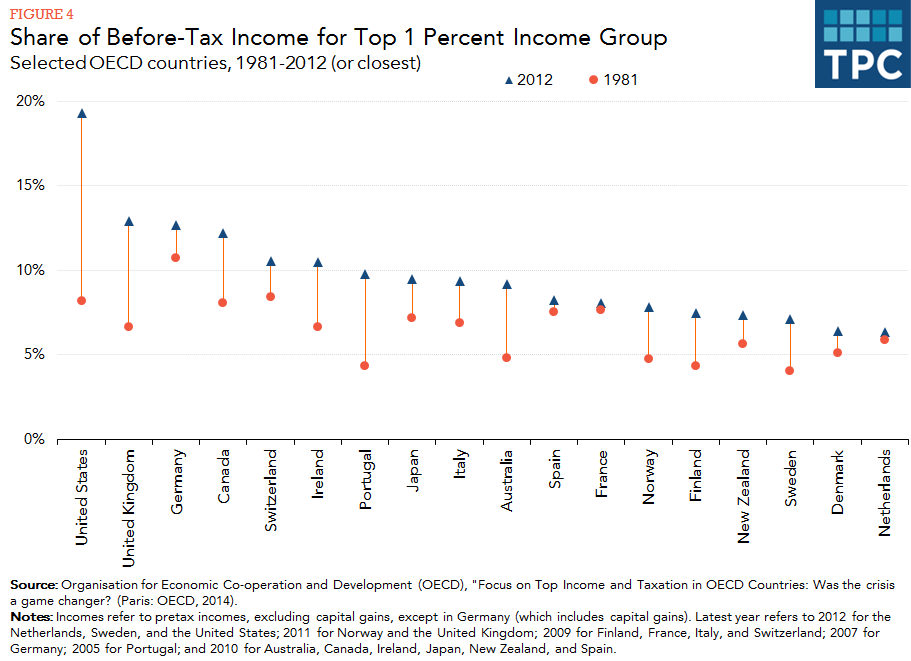

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Proposed Tax Changes For High Income Individuals Ey Us

10 Tax Planning Strategies For High Income Earners Gamburgcpa

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

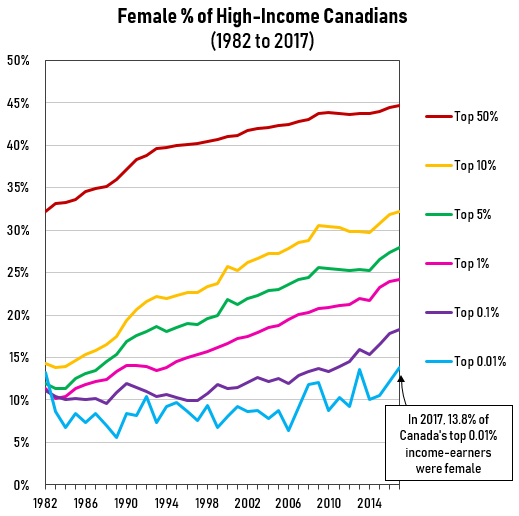

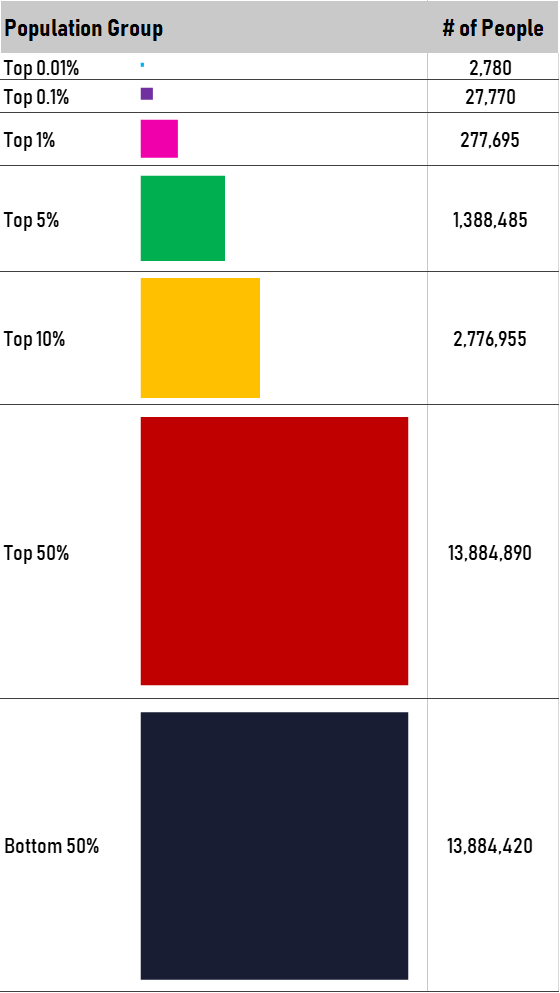

Interesting Data About High Income Earners R Financialindependence

Liberals To Go Further Targeting High Income Earners With Budget S New Minimum Income Tax Saltwire

How To Reduce Taxes For High Income Earners In Canada

Tax Planning For High Income Canadians Mnp Accounting Business Consulting And Tax Services

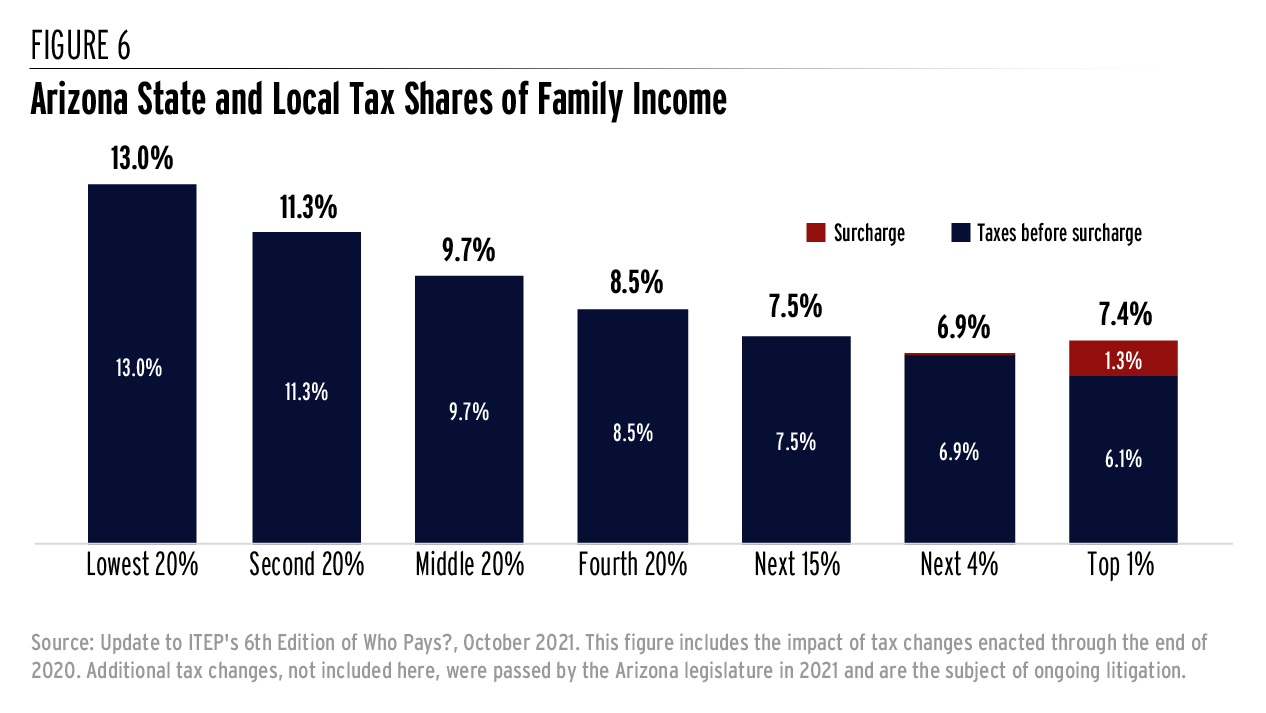

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

High Income Earners Need Specialized Advice Investment Executive

Liberals To Go Further Targeting High Income Earners With Budget S New Minimum Income Tax R Canada